![]() Call accumulator theta describes the change in the fair value of a call accumulator due to a change in time to expiry, i.e. it is the first derivative of the call accumulator fair value with respect to a change in time to expiry and is depicted as:

Call accumulator theta describes the change in the fair value of a call accumulator due to a change in time to expiry, i.e. it is the first derivative of the call accumulator fair value with respect to a change in time to expiry and is depicted as:

![]()

where P is the call accumulator fair value and t is time to expiry.

Evaluating Theta

Call Accumulator Theta = Payout1 x Digital Call Theta(K1) + Payout2 x Digital Call Theta(K2)

+ Payout3 x Digital Call Theta(K3) + Payout4 x Digital Call Theta(K4)

where the terms to the right are the digital call option theta with strikes K1, K2, K3 and K4 respectively.

Payout1 = 0.1, Payout2 = 0.2. Payout3 = 0.3 and Payout4 = 0.4

Call Accumulator Theta Over Time

Call accumulator theta is displayed against time to expiry in Figure 1. The black 0.1-day profile shows the theta increasingly rising and plunging around zero as the increasing payouts take effect. With 25-day to expiry the profile is almost flat. The averaging of all four strike’s digital call thetas smooths the manner in which the fair value decays and appreciates.

| European Digitals | Call Accumulator | Call Accumulator Delta | Call Accumulator Gamma | Call Accumulator Vega |

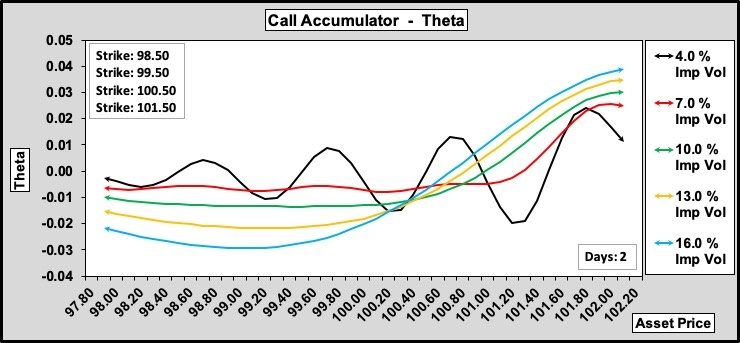

Call Accumulator Theta and Volatility

Implied volatility has a slightly different effect. The higher the ‘vol’ creates a more negative theta at low asset prices. It rises as it travels through all the strikes where the theta is now positive.

As volatility falls various strange effects take place on the theta until ‘vol’ is so low that the theta profile resembles the individual digital call options theta adjusted by the payout of each strike.

Below the asset price of approximately 100.50 the theta is negative if we overlook the 1.50% profile. This is because the call accumulator is out-of-the-money ‘on average’ so the value of the call accumulator will decline. Above 100.50 the theta is generally positive as the call accumulator is in the money and time is passing so the call accumulator value is rising.

Summary

The call accumulator theta is the theta of four weighted average digital calls. The weighting is to the right and so the call accumulator theta is strongly positive at the upper strikes and mildly negative at the lower strikes.

The higher the volatity and/or the shorter the time to expiry the greater the out-of-the-money theta will be and the steeper the rise to the in-the-money theta.

Ultra short-term theta and/or excessively low volatility make the call accumulator theta increasingly unfit for purpose.