![]() Digital put vega is the metric that describes the change in the fair value of a digital put options due to a change in implied volatility.

Digital put vega is the metric that describes the change in the fair value of a digital put options due to a change in implied volatility.

![]()

where ![]() is vega, P is put value and

is vega, P is put value and ![]() is volatility.

is volatility.

Digital put options vega is the first derivative of the digital put option value with respect to a change in implied volatility.

Digital Put Vega Over Time

Figure 1 illustrates profiles of the $100 digital put vega for a selection of days to expiry.

What immediately becomes apparent is that, as with the digital call vega, the in-the-money put options have negative vega. The out-of-the-money digital puts have a positive vega. This is because a higher implied volatility goes hand-in-hand with a higher volatility of the underlying asset.

Out-of-the-Money Put

If the digital put option is out-of-the-money then an increase in volatility will increase the chance that the asset price will fall below the strike. This would generate a winning bet as the price rises to the 100 settlement price.

An alternative scenario would be that if the underlying price has a volatility of zero. Then the price would simply not move meaning that an out-of-the-money option is destined to remain a loser. Therefore an out-of-the-money digital put option’s fair value will rise in concert with a rise in implied volatility and therefore the digital put vega is positive.

In-the-Money Put

When the digital put option is in-the-money, a static underlying price will mean that the option will remain in-the-money. It will subsequently be a winner. A rise in volatility will therefore increase the chances that the underlying price will rise above the strike and the bet will become a loser. This would in turn lead to a lower digital options price.

The in-the-money case will be reversed if there is a fall in the implied volatility. A fall in ‘vol’ will signify less movement in the underlying price thereby increasing the probability of the strategy being a winner. This in turn will make the digital put price worth more.

The 0.1-day to expiry profile is zero apart from a narrow range around the strike. This reflects that, as can be seen from Fig.2 of digital put options, there is only a narrow range around the strike where the options premium does not equal 0 or 100. The 0.5-day, 2-days etc. profiles have progressively more time to expiry. This leads to the peaks and troughs of the profiles progressively move away from the strike. Nevertheless, the absolute maximum value of the digital put options vega remains fairly constant across the number of days.

| European Digitals | Digital Put Options | Digital Put Delta | Digital Put Gamma | Digital Put Theta |

Digital Put Option Vega and Volatility

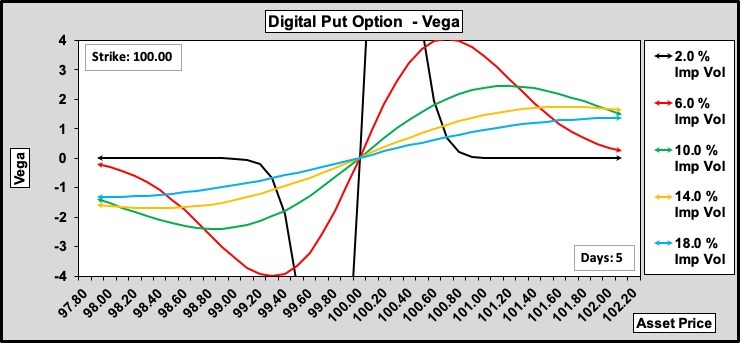

Figure 2 provides digital put vega profiles over a range of different implied volatilities.

Digital put vega is zero when at-the-money. This means that as the underlying passes through the strike the position will change from short vega to long vega, or vice versa. Yet again, as with digital call theta, digital call vega and digital put theta, the digital put option is not a good choice for taking a view on implied volatility.

Example: the asset is trading at 101.00, there are 5 days to expiry and volatility is 25%. The trader sells the 100.00 put in the belief volatility will fall. The following P&L graphs and table offer the P&L at 98.00, 99.00, 100.00, 101.00 & 102.00 with volatility at 15%, 25% and 35%.

| $98.00 | $99.00 | $100.00 | $101.00 | $102.00 | |

|---|---|---|---|---|---|

| 15% | -$5,045 | -$3,470 | -$1,311 | $840 | $2,409 |

| 25% | -$3,762 | -$2,674 | -$1,334 | $0.0 | $1,185 |

| 35% | -$3,238 | -$2,324 | -$1,357 | -$396 | $507 |

If one were to take the view that implied volatility will fall one might consider selling an out-of-the-money put. This would initially create:

- directional risk of the underlying price falling.

- A volatility risk of a rise in implied volatility.

- If the underlying fell through the strike the trader is now at risk of the volatility falling!

Summary

It is fairly clear that having taken reader through vega for both digital calls and digital puts that neither call or put are suitable for volatility trading. This is because of the switchback vega ride as the asset price passes through the strike.

Hamish Raw