![]() The eachway tunnel (ET)is a volatility trade, as are standard tunnels. The ET has a further two strikes providing three different settlements levels, not counting the ‘dead heats’.

The eachway tunnel (ET)is a volatility trade, as are standard tunnels. The ET has a further two strikes providing three different settlements levels, not counting the ‘dead heats’.

Eachway Tunnel Valuation

The ET is calculated as:

ET = R1 x Digital Call(K1) + R2 x Digital Call(K2) – R2 x Digital Call(K3) – R1 x Digital Call(K4)

where:

K1 is the lowest strike, K2 the next highest strike, K3 the next highest strike while K4 is the highest strike, and

R1 + R2 = 1 and R2 ≥ R1, and

K2 – K1 = K4 – K3

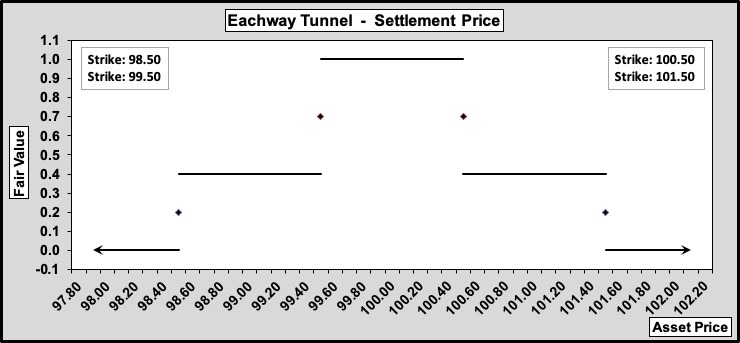

Eachway Tunnel at Expiry

The examples offered in Figures 1a & 1b are the 98.50/99.50/100.50/101.50 ET which settles at zero outside the outer two strikes, between the inner two strikes the strategy settles at 1.00, while between the inner strikes and outer strikes the settlement price is 0.40 (Figure 1a) and 0.25 (Figure 1b).

The ET provides a second place (or rebate) for the buyer who believes the underlying will be between the two inner strikes but gets it marginally wrong as the asset price settles between inner and outer strikes.

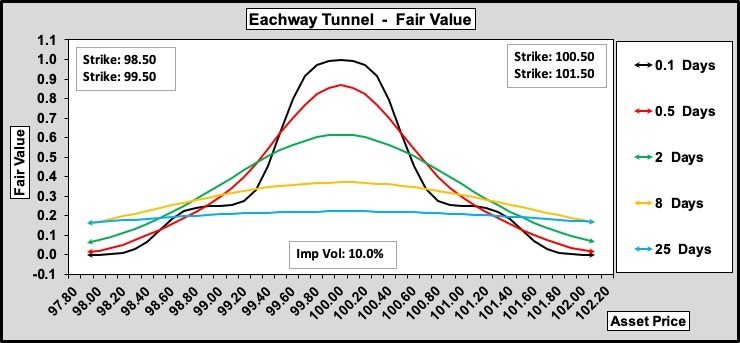

ET Over Time

Figures 2a & 2b provide the ET price profiles over a range of days to expiry, 10% volatility, and different settlement values of 0.40 and 0.25.

The 25-day (blue) ET of Figure 2a has a value that travels from 0.1876 and 0.1933 at the outer levels (97.80 and 102.20) of the range to just 0.2643 with the underlying at 100.00; this reflects low ET delta and ET gamma. The 0.5-day to expiry (red) profile is still smooth and still has not adopted the ‘head and shoulders’ expiry settlement shape. With 0.1 days to expiry (black) the ‘head and shoulders’ profile is now pronounced with greatest risk for the trader and market-maker when the underlying is close to the two inner strikes.

The 0.5-day and longer ET price has profiles akin to short conventional straddle price profiles but without the unlimited downside risk. This strategy has the ability to compete with its conventional options counterparts and has clear attractions for both traders and clearing houses.

Figures 2a & 2b where the underlying asset prices are at the edges of the graph, i.e. at 97.80 and 102.20, the ET can also offer a directional play. With 2 days to expiry Figure 2b shows the strategy is worth about 0.490 and 0.530 at 97.80 and 102.20 respectively. If the underlying rallied from 97.80 or fell from 102.20 to 100.00, where the ET is worth about 0.6148, returns of 1,155% and 1,057% could be achieved. These returns would be 1,941% and 1,781% if the underlying was between the two central strikes at expire although a moves of this magnitude would undoubtedly lead to higher volatility therefore a lower value at 100.00

| European Digitals | Eachway Tunnel Delta | Eachway Tunnel Gamma | Eachway Tunnel Theta | Eachway Tunnel Vega |

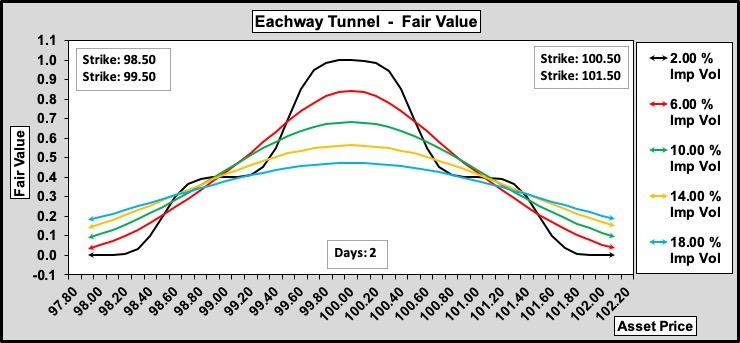

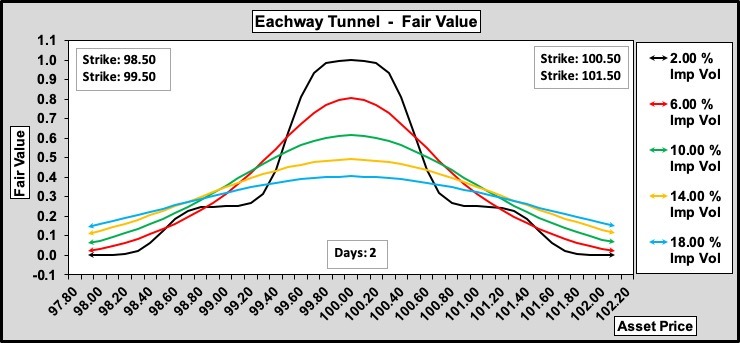

ET and Volatility

The underlying asset has now risen in a day to 100.00 from 97.80. If the volatility remained the same at 10% then the profitability of the purchase of this 2-day ET is fairly evident from Figures 3a and 3b.

But when the ratio is 0.25.100 as in Figure 3b the rise in volatility from 10% to 14% sees the profit fall by as much as the green profile at 100.00 to the yellow profile where the ET is worth only 0.4910, a fall of 0.6148 – 0.4910 = 0.1238.

Summary

- The eachway tunnel consists of two tunnels, one embedded inside the other.

- When the asset price settles within the outside tunnel strikes but outside the inner tunnel strikes the trader receives a rebate. In the above examples the rebate is 0.40 and 0.25.

- The eachway tunnel’s primary use would be to take a position on the volatility of the asset price.

- An eachway tunnel could also be used as a directional play. For example, if the asset price was below the lower strike or above the upper strike a purchase of the eachway tunnel would respectively create a long position and short position in the asset.