![]() Tunnel options are the most simple means of speculating on the future volatility of an asset price. The tunnel option is structured in the same way as a conventional call spread, long one lower strike call and short one higher strike call.

Tunnel options are the most simple means of speculating on the future volatility of an asset price. The tunnel option is structured in the same way as a conventional call spread, long one lower strike call and short one higher strike call.

Tunnel Options at Expiry

Tunnels options settle at 1.00 if, at expiry, the underlying is between the strikes or at zero if outside the strikes at. If the asset settles on either strikes (a draw) then the option settles at 0.50.

The tunnel buyer is similar to a conventional straddle seller in that they are both speculating that the underlying will be between two strikes at expiry. The difference between these strategies is that the straddle has a price profile with angles ±45° while the tunnel has vertical sides. This means that the straddle has a continuous price profile at expiry while Figure 1 depicts its discontinuous price profile.

The Tunnel is calculated as:

Tunnel Option = Digital Call(K1) – Digital Call(K2)

where K1 is the lower strike and K2 the upper strike of the tunnel option.

In Figure 1 the settlement price is zero outside the strikes and 1.00 inside. Should the underlying settle exactly on either strike then adopting the ‘dead heat’ rule would create a settlement price of o.50. Calculating the value of the tunnel option is akin to evaluating a conventional call spread, i.e. subtract the value of the upper strike digital call option from the value of the lower strike digital call option.

Tunnel Options and Time to Expiry

Between the strikes at the asset price of 100.00 as time passes the tunnel is worth more. This indicates that at 100.00 the tunnel has positive tunnel theta.

Figure 2 shows the middle point between the strikes is at 100.00. If the 101.00 digital call is worth 0.25 one might reasonably expect that the 99.00 digital put to also be worth somewhere close to 0.25. Hence the 99.00 digital call would be worth 1.0 – 0.25 = 0.75. The tunnel would then be valued as:

99.00/101.00 Tunnel = 99.00 digital call – 101.00 digital call

= 0.75 – 0.25

= 0.50

For the 99.00 digital put to have the same as the 101.00 digital call would require:

- Interest rates are zero so no cost of carry

- The implied volatility of the 99.00 digital put is the same as the 101.00 digital call

- Same time to expiry, and

- A Normal bell-shaped distribution applies OR a lognormal distribution with very short time to expiry and/or very low implied volatility.

| European Digitals | Tunnel Delta | Tunnel Gamma | Tunnel Theta | Tunnel Vega |

Tunnel Options and Volatility

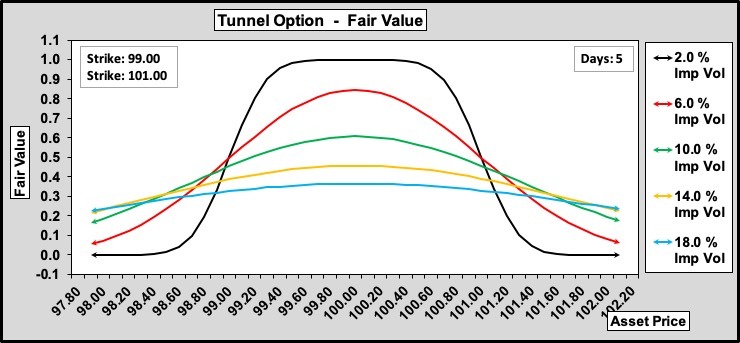

The tunnel is clearly a volatility play if bought or sold with the underlying price within the two strikes. Figure 3 illustrates the 99.00/101.00 tunnel over a range of implied volatilities.

A buyer of the tunnel option may believe that the implied volatility is too high as, for example, a series of national holidays are coming up with traders thoughts diverted away from trading and more on their sun tan lotion. If, on the other hand, the speculator believes the market will become more volatile a sale of the tunnel would be appropriate.

Example: the trader who believes that an asset price may become less volatile might consider that the probability of the asset price being over 101.00 at expiry only 15%, i.e. the digital call should be worth 10 ticks less than the current 0.25 price tag. This would suggest that the 99.00 digital put should worth around 0.15 also, leading to the 99.00 digital call being worth 0.85. This would imply a tunnel price of 0.70 (0.85 – 0.15) which in itself is implying that there is a 70% chance of the underlying being between the strikes as opposed to the current 50% market forecast.

Tunnels as a Directional Play

If the tunnel was out-of-the-money when bought, i.e. the asset price was below the lower strike or above the upper strike, then the trade is a directional play as the buyer is speculating that the underlying is going to move towards the strikes.

- If, with the underlying at 100.00 a trader fancies the market up then they could buy the 101.00 digital call for 0.25.

- Should the trader be correct and the market rises to 101.00 then the trader might sell his digital call at 0.50 and close out for a 0.25 profit.

- Alternatively he may hang on and wait for the underlying to rise to 102.00 where he may sell the 103.00 digital call for 0.25.

- At this point the trader has bought the 101.00/103.00 tunnel for zero.

- If instead of 4. the trader hung on for the underlying to trade 103.00 then the 103.00 call could be sold for 0.50, meaning that the trader has now banked a profit of 0.25 along with owning the 101.00/103.00 tunnel for nothing. In effect the trader has paid -0.25 for the tunnel which has to settle between 0 and 1.00.

‘Legging’ into structured positions, such as the tunnel option, could become an important part of the everyday strategy of the digital trader.

Summary

The tunnel is the first of four volatility strategies that could well be considered as the equal or ever superior to the conventional straddle and strangle. Providing retail customers with limited risk versions of the straddle and strangle is a safer way of betting on a fall in volatility than a sale of straddles or strangles. Unfortunately regulators in Europe and Australia do not see things that way and would appear to want to only offer retail an investment landscape where unlimited losses exist.